Time to read: 3 min

With international manufacturing and global trade playing such an important role in today’s product development world, it’s important to understand how logistics work in every part of the import and export processes.

Aside from understanding incoterms and establishing them with your supplier, HS codes and HTS codes are the other big piece of the puzzle. What are they? How can they impact your process and bottom line? We’ll help lay out the basics and give you all the information you need to know.

What are HS Codes?

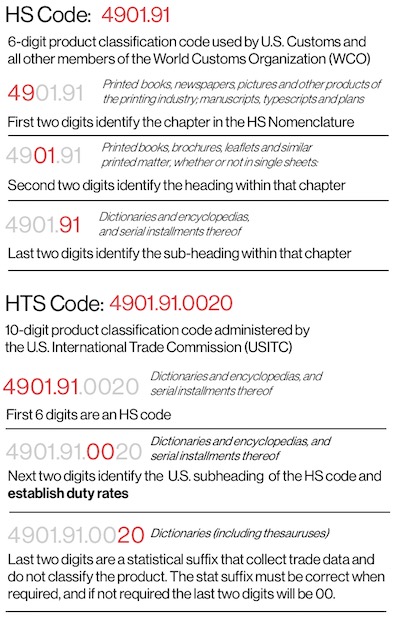

Harmonized Commodity Description and Coding System codes, or HS codes, are special six-digit codes used to designate what a product is, and how it’s classified, according to all members of the World Customs Organization (WCO). Since the United States is a member of the WCO, U.S. Customs relies on HS Codes to understand all products imported into the United States.

If you’re working with any vendors outside of the United States, you’ll need to reference an HS Code. Since HS Codes are international standards, they will apply in about 98% of cases. However, if you’re looking for more specifics about importing into the United States, you’ll need to read up on HTS Codes.

What are HTS Codes?

A Harmonized Tariff Schedule code, or HTS code, is a ten-digit code that specifies the import classification for goods coming into the United States. This list of codes actually determines customs duties for those goods. There are currently over 17,000 unique codes in place for use, and they aren’t as straightforward as you might think.

The first six-digits of an HTS code actually correspond to a universal HS code, so it’s crucial to designate the correct final four digits. It’s also important to note that HTS codes in one country may not align with the HTS codes used by another. Many Chinese suppliers will provide an HTS code, though they may supply the Chinese variation of the HTS code.

Why are they important?

The most important distinction between HS and HTS codes comes down to the fact that the differing four digits could completely change how your goods are classified, depending on the code you use. Since these codes dictate how much you have to pay on your imported product, it’s important to understand your exact costs, so you’re not paying more than you should.

In the above chart, for example, the HS code for a dictionary falls under 4901.91. However, the HTS code gets more specific—if you’re importing to the United States, the additional four digits make a world of difference. Is your product technically a dictionary (4901.91.0020) or an encyclopedia (4901.91.0040)? If you think it could actually be classified as a textbook, it would require a different code altogether (4901.99.0010). Along with those minute differences in classification for import to the United States, if you’re exporting to another country, those HTS codes may be different.

At Fictiv, we confirm with our customers the end use and HTS code designations for all of our overseas orders. That way, we can ensure that the information is properly represented on export / import documentation and avoid shipping delays or incorrect customs payment amounts.

Additionally, as many of our customers are ordering prototype / non-commercial parts through our platform, those customers have the option to use the 0% tariff prototype HTS code (where applicable) to help reduce landed cost.

Main Takeaways

Ultimately, product classification is very important. Using the incorrect code may result in fines and/or other penalties. Luckily, the US International Trade Commission has a search tool available online to help you find the exact code that you need.